Anti-Fraud Technology

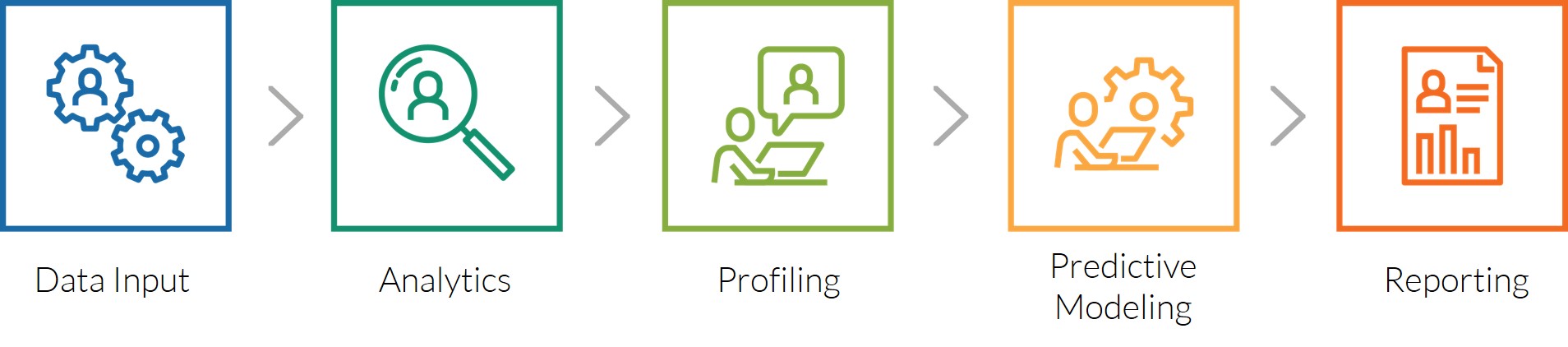

Using customized algorithms in conjunction with custom-built databases, analytics, profiling, predictive modeling, and reporting results in PHG being able to provide clients the capability to identify and index fraud, perform proper benefit plan design, reduce spend, and the opportunity to offer additional benefits at a lower cost.

When offered, the anti-fraud and proper benefit plan design technology will:

- Contain indexed data on benefit plans, billing codes, and provider networks for analysis

- Offer analytics on benefit plan designs, member utilization, and quality controls

- Perform profiling of procedure code usage and provider treatment planning

- Execute predictive modeling and stratifying on members’ usage and provider fraud

- Provide analysis and recommendation reporting on benefit usage and negative happenings

- Create proper benefit plan designs for increasing benefits and reducing fraud (costs)

A majority of insurance carriers, self-funded companies, health maintenance organizations, third party administrators, administrative services organizations, and reinsurers that currently interact with the public sector (federal government, state agencies, local municipalities), the private sector (Corporate America, small business, non-profits, school districts, utility companies), and the Taft Hartley sector (labor unions) do not have the knowledge or capability for identifying the multiple types of fraud or the expertise to properly design benefit plans for maximizing their opportunities and preventing fraud.

PHG’s comprehensive anti-fraud and proper benefit plan design technology will include data bases with certified procedure codes, various types of dental plans, statistics on procedural code usage, dental networks, and conversion capabilities. The company’s proprietary software will have the capability to perform various analytic processes, provider profiling, benefit program analysis, and predictive modeling. The Company’s reporting will include identifying the types and mechanics of fraud, excessive and unnecessary spending areas, creating proper benefit plan design programs, opportunities for enhancing their existing dental benefits, and offering new and additional benefits without increasing their cost.

Developed, the initial components of the proprietary software will be:

- Data Base - benefit plans, claims statistics, and conversion of billing codes

- Analytics - for existing benefit plans, utilization, and quality controls

- Profiling - each provider’s usage of billing codes (industry norm versus used)

- Predictive Modeling - projection of in and out of network usage and costs

- Reporting - usage versus national average and proper benefit plan design

When provided, the anti-fraud and proper benefit plan design technology will:

- Contain indexed data on benefit plans, billing codes, and provider networks for analysis

- Offer analytics on benefit plan designs, member utilization, and quality controls

- Perform profiling of procedure code usage and provider treatment planning

- Execute predictive modeling and stratifying on members’ usage and provider fraud

- Provide analysis and recommendation reporting on benefit usage and negative happenings

- Create proper benefit plan designs for increasing benefits and reducing fraud (costs)

PHG uses the customized algorithms, data bases, analytics, predictive modeling, and reporting to provide clients the capability to identify and index fraud, complete proper benefit plan design, gain a reduction in spending, and the ability to offer more enhanced benefits without increasing their costs or reducing their current offerings… Guaranteed!

The anti-fraud and proper benefit plan design products will allow each client the capability to:

- Identify and index types of fraud, prevent future occurrences, and reduce their overall spend

- Enhance existing benefits while simultaneously adding new ones without increasing costs

- Create proper benefit plans without limiting access, increasing deductibles, adding co-pays or eliminating any current benefits.

Free Benefits App

The free benefits app’s available discounted healthcare benefits combines the company’s independent nationwide discount dental provider network with other healthcare companies (networks, retail establishments, mass merchandisers, and manufacturers) involved in medical, hospital, pharmacy, vision, hearing, podiatry, wellness, chiropractic, durable medical equipment, diabetic supplies, vitamins and supplements, naturopathic medicine, patient advocacy, and other healthcare services to form a coalition. The company’s free benefits app results in allowing every American access to a large spectrum of new, enhanced, and affordable nationwide healthcare benefits - resulting in each person gaining an increase in value and a decrease in their spending, regardless to their current benefits - or none.

The free benefits app products will allow every American (insured, underinsured, or uninsured):

- A variety of new and affordable benefits without needing to join a program or pay upfront

- Gain an immediate increase in value to their existing benefits and a decrease in their total spend

- Be rewarded with monetary gains, enhancements, and opportunities each time the app is used

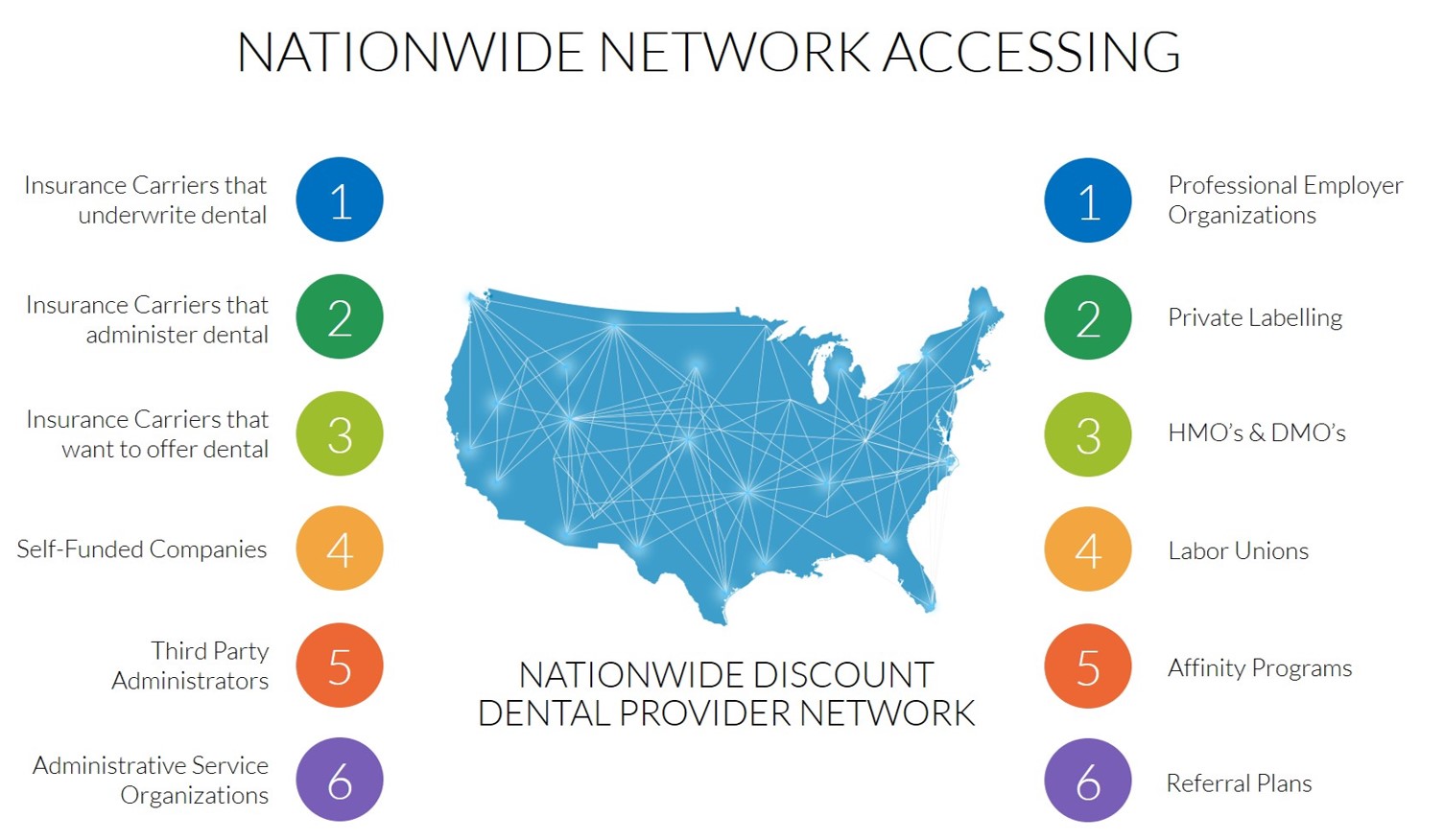

Network Accessing

Network Accessing is when an insuring entity or benefit plan administrator (e.g. insurance carriers, self-funded companies, health maintenance organizations, third party administrators, reinsurers, labor unions, and administrative service organizations) “leases” a discount provider network to gain an increase in value and a decrease in spend, regardless to their current healthcare benefits - or none. There are twelve major revenue channels from network accessing.

Healthcare providers are willing to reduce their fees in order to participate in discount provider networks, in exchange for marketing their businesses’, that results in new patients and recurring revenue. Of the 175,000 dentists now practicing in the United States… 105,000+ will participate by agreeing to pre-set itemized benefit fee schedules that are discounted below their geographic area’s usual and customary fees. This will result in the company owning a revenue producing tangible asset. The independent nationwide discount dental provider network will enable insurance carriers, self-funded companies, health maintenance organizations, third party administrators, reinsurers, labor unions, and administrative service organizations the opportunity to enhance their existing portfolio of benefits and offer new and additional benefits at no additional cost. For the uninsured, the independent nationwide discount dental provider network will provide a large spectrum of new and affordable dental benefits in the form of a discount program.

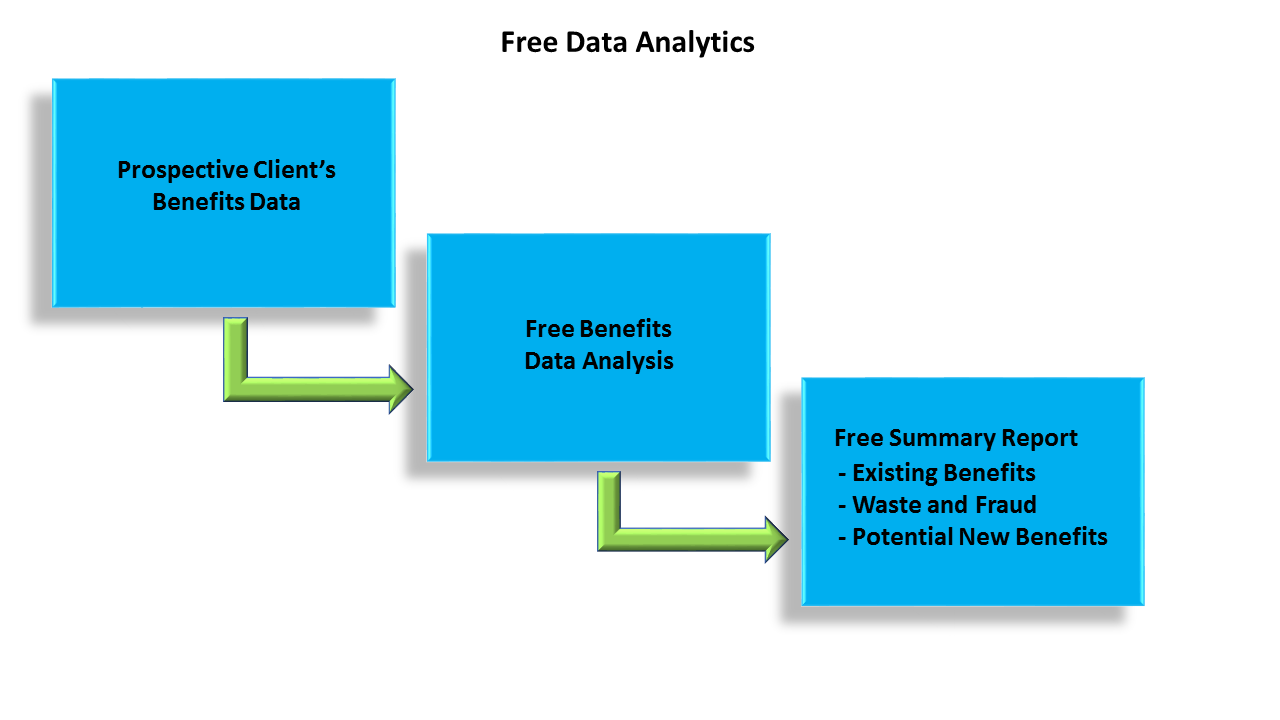

Free Data Analytics

Using proprietary software and customized analytics, PHG offers to all of its prospective clients a free analysis of their existing healthcare benefit plans, their overall costs for their benefits, their set-up for identifying waste and fraud, and a summary of their previously paid claims.

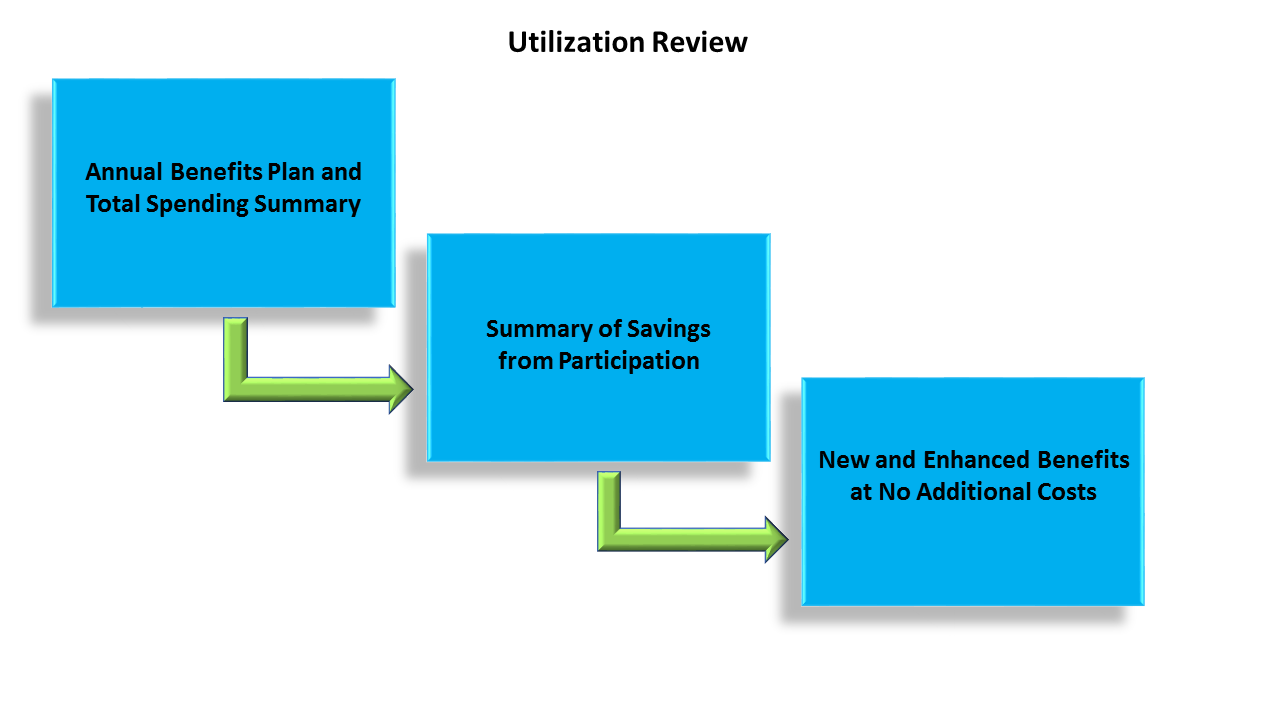

Utilization Review Analysis

Primacy Health provides each of its clients with a free annual summary report that includes a categorization of their total spend, proof of their actual dollar savings from PHG’s product, and provides suggestions to offer new and enhanced healthcare benefits without needing to reduce any existing benefits or incurring any additional cost.